We realize that the crypto markets have suffered a good deal of volatility in the recent weeks. A public token sale is by definition a participatory venture, where everyone succeeds only if the whole thing succeeds. You don’t have to worry, we are far behind hitting our soft cap, and we have already agreed with multiple exchanges to list our SGN token starting from the beginning of May 2018.

Nevertheless, we’re just getting closer to hitting a third of our target cap and the token sale end has been postponed untill the end of the month, April 30th, 2018. Therefore we’d like to tell you a bit about how we’re making sure that the public token is a great success and a great opportunity for everyone.

- Who comes first, earns more

There is still time to buy discounted SGN tokens. The first participant of the Token Sale had a discount of 15%. Currently, the discount is around 12%and keeps getting smaller with every SGN token purchase.

2. We have fixed price of Ether at $1000

To protect token sale participants from the recent drop of the Ether price in USD and with a belief that the market will recover soon, we have decided to fix the ETH price at the rate $1000 in the Signal Token Sale smart contract. With the current price of Ether at approximately $500, you will get one SGN token for $0.18 instead of the base price at $0.36.

3. All potentially unsold tokens are redistributed among token sale participants.

The pool of tokens dedicated to the token sale amounts is 50% of the total token supply. In case there are any unsold tokens left in this pool after the end of the token sale, we will redistribute all remaining tokens to the SGN token sale participants.

This means that in case the hard cap is not reached, your bonus will be even higher.

We believe that the combination of those three benefits makes the participation in Signals token sale an interesting investment opportunity.

Please let us know if you have any questions.

Please let us know if you have any questions.

Crypto markets have suffered a good deal of volatility in the recent weeks, with the price of Bitcoin dropping below $9,000, altcoins are following the same path, including Ethereum.

We believe in a decentralized future, and Vitalik Buterin’s ingenious idea materialized into the Ethereum blockchain. Even though its price has been volatile, we think that its potential is enormous; big companies have integrated it into their operations, top universities have set up lectures about it, more and more bright minds are establishing progressive and disruptive companies based on it. Therefore, we think that the current price of Ethereum does not reflect its potential and real value.

Many projects doing the ICO, including Signals, start a Token Sale by locking the token price in Ethereum according to the current rate USD/ETH 24 hours before the start of the sale. As many other alts, the Ethereum price is dropping, with the current value below $700 (ATH ~$1400) [30/3 update: ETH price is +- $390). Locking the price at $700 or lower amount could lead to an unfair situation during the 4 weeks of the main sale where investors get SGN tokens according to an Ethereum price locked at $700 when in that moment it is above $1000.

To avoid this, and with the objective of having a fair and satisfactory Token Sale for everyone, we have decided to give you an advantage. We have decided to fix the price of Signals (SGN) token at an Ether price of $1,000,even though its current market value is approximately at $700.

This decision also applies to our presale participants: We will give presale participants the same conditions when purchasing SGNs during the Token Sale. Although we’re aware that our presale participants purchased tokens when the market price of Ethereum was significantly lower than $1,000, they will receive additional SGN tokens as if the price of ETH was at $1,000.

What if Ethereum surpasses $1,000 during the Signals Token Sale?

If the price of Ethereum rises even more during the Token Sale and it surpasses the price fixed at $1,000 at the beginning of the sale, the total market value of raised ETH will reach the $18,000,000 hard cap sooner. In this case, we will stop the sale immediately and redistribute the rest of the tokens to all Token Sale participants (respecting the discount they receivedwhen they bought SGNs). That’s how we will ensure that even if the ETH value raises, the Token Sale will remain fair for all participants — including the first and the last participants, as well as participants from the pre-sale and the main sale.

Read our blog posts to find out more about how to participate in the Signals Token Sale and how the first participants get the largest discounts.

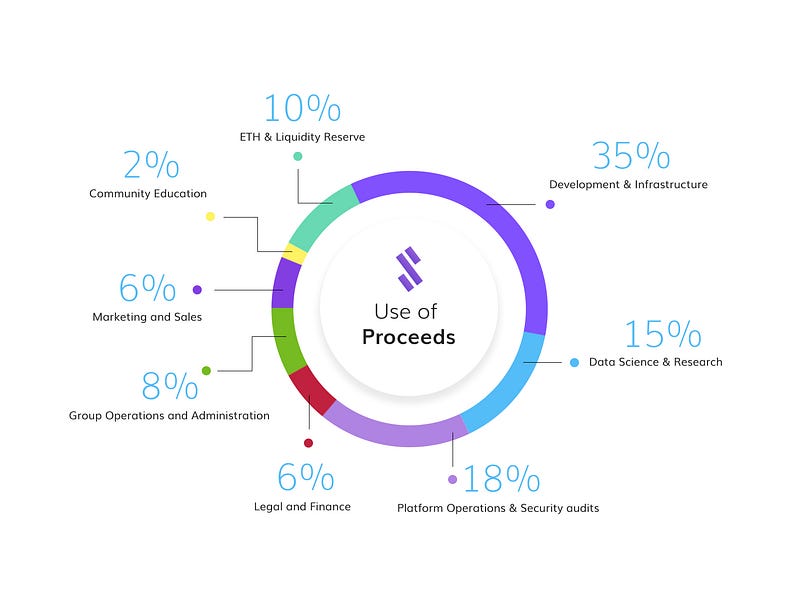

How does Signals plan to allocate funds raised in the Token Sale?

Our team intends to use a substantial amount of all of the proceeds of the SGN Token Sale to originate and subsequently to progress the development of the Signals Platform. Below, we break down just how the raised funds will be allocated. Keep reading to learn more!

Approximately 35%: Development and Infrastructure

We engage UI/UX experts, enterprise solution architects and developers, machine learning developers, distributed algorithms experts, mobile app developers and testers. It’s our goal to implement a cloud-based platform, daily processing of terabytes of data, connections to decentralized cloud computing system and other blockchain services, exchange connections.

Approximately 15%: Data Science and Research

Research is important to Signals. It helps us develop the Signals Platform, as well as to gather collective data science knowledge. Our aim is to do this through utilizing machine intelligence experts. We plan to support machine learning research and also contribute to it ourselves, using any new machine learning techniques available to deliver our users a more refined and optimized product

Approximately 18%: Platform Operations & Security Audits

It’s our goal to protect customers’ finances by providing continual quality assurance of our code and strategies. Further operations and auditing tasks include: data storing and processing infrastructure, computational power, listing the SGN token on exchanges, purchasing of historical data sets, protecting user data and performing security audits.

Approximately 6%: Legal and Finance

It’s crucial that Signals needs to comply with legal obligations and the regulatory environment. This includes handling any legal and regulatory requirements to ensure we are in compliance with local laws in countries in which we operate.

Approximately 8%: Group Operations and Administration

This percentage of our proceeds is dedicated to general operational overhead expenses and office space.

Approximately 6%: Marketing and Sales

Proceeds dedicated to marketing and sales-driven initiatives cover the development of revenue streams and acquiring new users to become a global automated trading platform.

Approximately 2%: Community Education

This includes organizing meetups and educating people to be able to understand the trading patterns on their own.

Approximately 10%: ETH & Liquidity Reserve

Crypto currencies including ETH are volatile; a reserves helps provide comfort that even if the value drops, the company will have enough resources to operate and develop. This portion of the proceeds is also dedicated to an unexpected expenses reserve.

Please note: Signals reserves the right to modify its use of proceeds at its discretion, and all estimates provided as part of this Use of Proceeds post are subject to change.

Tidak ada komentar:

Posting Komentar